Beginner's Guide to Crude Oil Investing in India 2022

Introduction

Crude Oil is the backbone of global commerce, driving commodity, product, and service costs worldwide. It is also one of the most enigmatic commodities, remaining stable in the long term while being highly volatile in the short term. Crude Oil can be affected by global conditions and adverse events such as conflict, trade agreements, and the condition of transit routes, to name a few variables.

For those new to trading commodities, investing in crude Oil offers a secure avenue to earn well through informed decisions. This article explains everything you need to know about how to invest in crude Oil.

What is Crude Oil?

The unprocessed form of petroleum products extracted from the Earth is collectively called Crude Oil as an umbrella term. Differences in the regions where the Oil has been extracted are used as naming conventions to distinguish between different sources. In this context, Oil extracted from Texas, United States, is termed WTI Oil, while crude Oil from Europe is generally called Brent Crude Oil.

Brent price:

What is a Crude Oil Index?

The different types of crude oil trading under their specific names each have a particular market through which they are traded globally. Within each market are differentiated categories that allow trading of specific crude oil types. Taking the example of Brent, the markets available for trading various crude oil categories include the Blend, the Forties, Oseberg, and the Ekofisk (BFOE) market.

A crude oil index is a statistical data tool used to help inform investors regarding the future prospects of a particular type of crude Oil being traded in the market. An index forecasts crude oil prices in various regions and markets based on data available from the last month, quarter, or year.

Investors utilize Crude Oil indices to evaluate the performance of their crude oil investments over time.

Investing in Crude Oil

Investors can utilize three types of contracts when trading crude Oil.

1. Spot Contract

A Spot Contract refers to selling or purchasing crude Oil at the current market price. Spot contracts are effective immediately from the date of purchase, followed by the exchange of payment and goods.

Spot contracts are usually utilized by governments and agencies that seek to use the Oil directly. Investors do not prefer this type of contract unless a forward trade is already organized, enabling the investor to offload their assets to the market quickly.

2. Future Contract

A futures contract refers to the sale and purchase of crude Oil at a speculative price set at some point in the future. Investors, in this way, speculate on the future price of a set amount of crude Oil and may either profit or risk a loss if the assumed price does not match with the actual trading price of the commodity when the date of exchange arrives. Trading in futures is a speculative investment. It can be better secured by arranging forward contracts that enable investors to cover their assets in case of loss by trading further to more favorable markets.

3. Contract for Differences

A contract for differences refers to the trading of commodities at a speculative future price, where the investor is compensated for the difference in the speculated and actual price at the time of the closing of the contract. This means that investors can speculate on the future price of a commodity, such as crude Oil, and predict whether the price will rise or fall. The investor is then paid the difference between their predicted price and the actual price of the commodity at the time of the trade.

Which Is the Better Trading Option?

Seasoned investors usually prefer trading through a futures contract as it enables them to gauge their investment performance before the actual exchange is initiated. A futures contract is preferable for seasoned investors who can trade large quantities of the commodity.

For new investors and those who wish to hedge the risk profile of their investments for a more profitable trade, the best option is to trade through CFDs. A CFD enables investors to lower their investment risk profile while allowing a healthy return on investment if the investors make well-informed decisions.

How Can I Invest in Crude Oil?

Crude Oil is an incredibly valuable commodity. This makes investing in crude Oil a highly profitable venture for beginners and experts alike. Several people have reached out to us to ask how to trade crude Oil in India, and other regions of the world, as these emerging markets are searching for safe avenues for investment.

To begin your crude Oil investing journey, you must first know where these commodities are traded.

The WTI crude oil trades on the New York Mercantile Exchange (NYMEX), while the Brent Crude trades on the Intercontinental Exchange (ICE) as a commodity. But these exchanges cater to substantial trades, often to the tune of millions of barrels of Oil.

New investors can find more accessible crude Oil investing platforms that enable lower risk profiles by offering CFD and other financial instruments specifically curated for individual risk appetites.

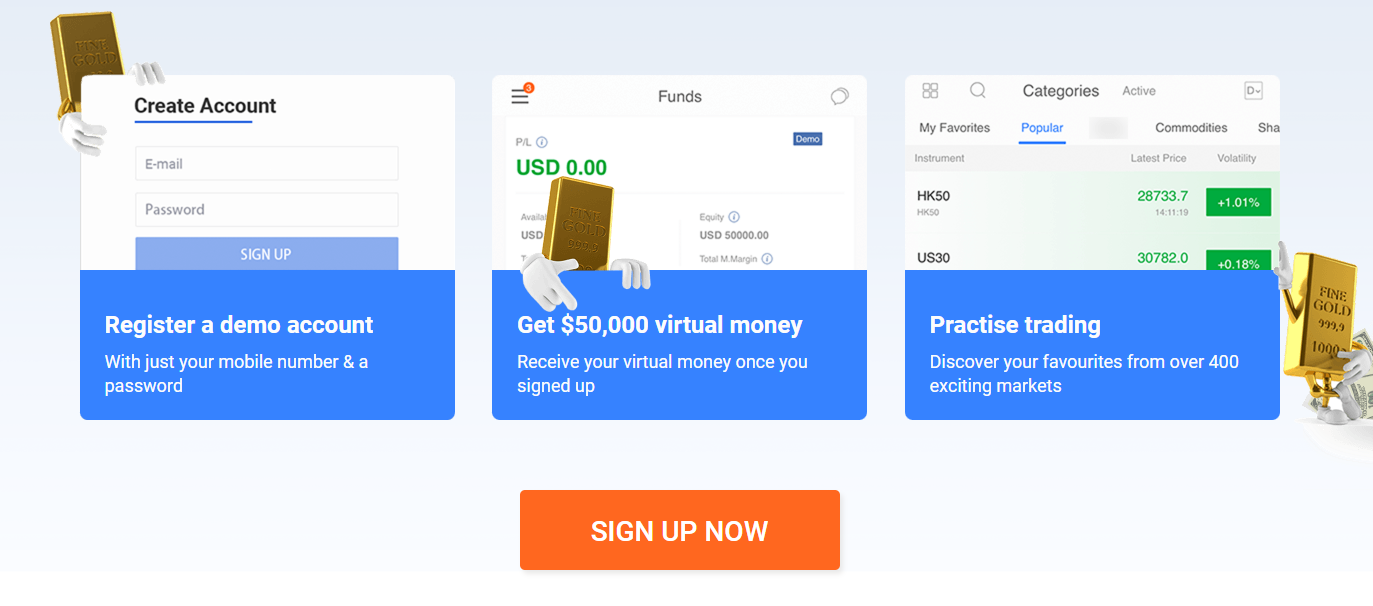

Secure platforms, such as MiTRADE, offer a simplified and accessible way to invest in crude Oil and other commodities and keep track of your investment portfolio through a unified dashboard.

Trading Platforms like MiTRADE have been gradually growing in popularity due to the relative ease and safety they provide to new investors, along with learning tools and insights that can help traders make sound judgments.

Conclusion

Investing in crude oil price differences through CFD is a reliable and low-risk method for new investors. Crude Oil Investing can be highly profitable if other financial instruments such as leverage are utilized in conjunction with short and long-term positions for crude oil markets such as the brent crude oil index and the WTI. In summary, brent crude price investing and other crude oil investment avenues are excellent for investors to spread their wings and test the waters across global financial markets.

The content presented above, whether from a third party or not, is considered as general advice only. This article does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Mitrade does not represent that the information provided here is accurate, current or complete. For any information related to leverage or promotions, certain details may outdated so please refer to our trading platform for the latest details. *CFD trading carries a high level of risk and is not suitable for all investors. Please read the PDS before choosing to start trading.

- Original

- Trading Analysis

Risk Warning: Trading may result in the loss of your entire capital. Trading OTC derivatives may not be suitable for everyone. Please consider our legal disclosure documents before using our services and ensure that you understand the risks involved. You do not own or have any interest in the underlying assets.