CFD Gold Trading: The 'BASICS' You Should Know!

CFD gold trading focuses on the idea of gold price speculation. The changes in the prices of gold during the contract duration determine the profit and loss. Like other assets, you can trade gold as CFDs. You can buy it in the rising or falling market.

So one can trade when gold prices are rising or decreasing. You can short the assets in falling markets. It means selling gold and then buying it later at a higher value. You can also buy it low and then sell it when the prices of gold rise.

You should know more information on gold trading before getting into this business. Keep reading!

What Does Gold Trading Involve?

Gold trading in modern days involves price speculation. There can be a significant fluctuation depending on supply and demand pressures. So gold, in the form of investment, is also a determinant.

It is available in mobile phone and computer components and jewelry. Long-term investors and short-term traders populate the gold market. Gold is a popular commodity in the retail, industrial, and economic markets.

The metal takes up considerable space when it comes to emotional attachment. Different factors influence gold dealing and prices. Some are political turmoil, world vents, and business world affairs.

As a result, gold markets have now become volatile. Thus, it is a profitable metal with many opportunities, especially if you are a wise investor.

What are the Different Options to Trade in Gold?

There are different ways you can trade gold. Do this to diversify your portfolio. Here are a few ways:

1) Physical Buying:

Gold trading in India is possible through coins or bullions. Bullion is nothing but a weight bar. Buying the physical metal means you are always in charge. But, it might raise security concerns.

Do you know how expensive it can be to store gold? What about insuring it? So, this option of buying physical gold may not suit everyone.

2) Gold in the form of Certificates

Gold certificates aren't far from bank paper notes. The certificates act as proof that you own gold.

Some popular banks offer them today. So some investors might find this option to be suitable for them. But it still requires much physical work, like visiting banks, calling bank executives, etc.

3) Gold Futures

Gold futures are contract agreements for gold delivery at a pre-set future date. The price is also pre-set. Investors use this form to manage price risks.

The contracts offer better flexibility and leverage than trading physical gold. A primary concern is these contracts are limited by time. The buyer can impose a rollover fee in some instances.

4) Gold Options

Gold options are nothing but derivatives with gold futures or physical gold as a primary asset. The investor can buy or sell a certain amount of gold at a given price and date.

5) Gold-based ETFs

You can do online gold trading through ETFs. But, gold prices still affect ETFs. Gold ETFs allow investors to access various opportunities, especially with smaller capital amounts.

6) Stocks/CFDs

An investor can buy stocks or trade CFDs. But, CDFs prove to be better because the gold stocks' value doesn't entirely depend on the prices of physical gold. Instead, external factors like market sentiment can influence valuations.

CLICK HERE to know more about CFDS: https://in.mitrade.com/others/cfd/cfd-trading

5 Benefits of Gold CFD Trading

Online gold trade in India shouldn't be challenging. See some benefits of Gold CFD trading:

1) It doesn't involve the physical transportation of gold or storing it. Large amounts of gold take up a lot of space. The commodity lying around can make it unsafe.

2) You can use leverage when trading gold or other metal as a CFD. It is easy to multiply the available funds. But, while leveraging can multiply your rewards, it can increase the risk.

3) CFDs are the cheapest form to trade gold. We offer lower competitive spreads. Trust us for no hidden commissions or fees.

4) CFDs are liquid products. An investor can trade any quantity.

5) The flexibility is incomparable. Gold CFDs have no price decay or expiry dates like options or futures.

How to Trade Gold CFDs?

Here are simple steps to help you in online gold trading in India:

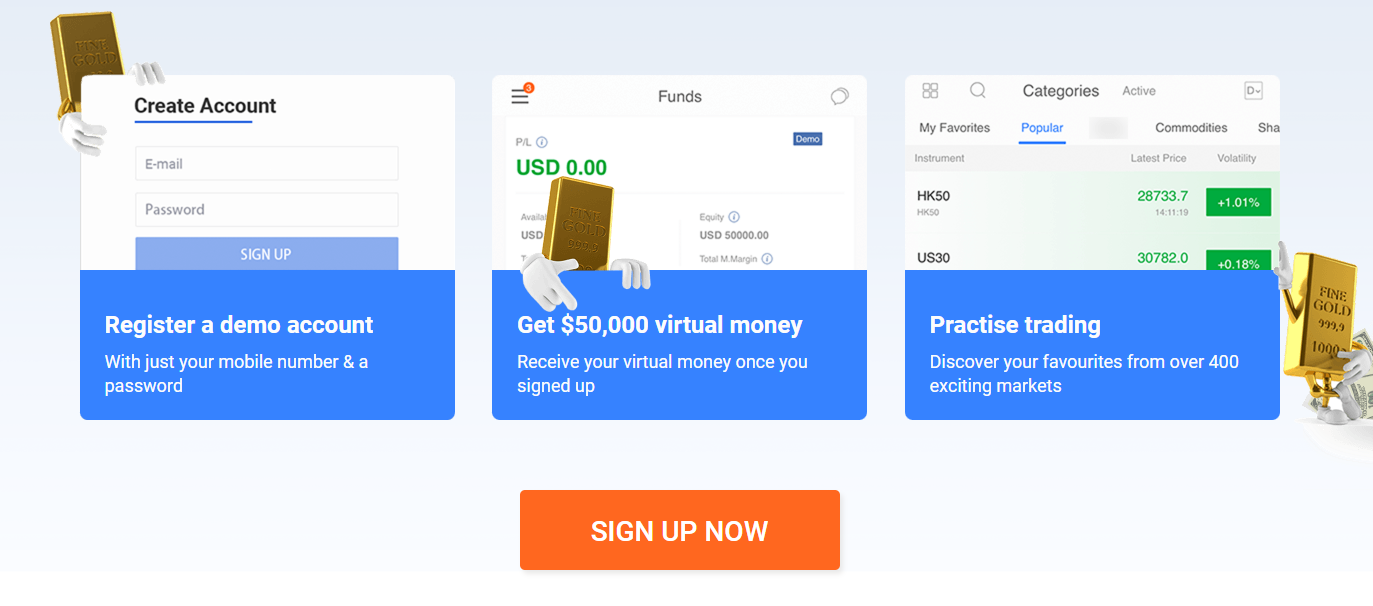

Step 1: Create an Account

Open a gold trading account at Mitrdae.

Step 2: Choose the Right Product

Choose the underlying gold product that suits you and your needs.

Step 3: Wait for the Right Opportunity

Identify the trading opportunities using your strategy.

Step 4: Start Trading

Open the first position to start CFD trading.

Step 5: Study the Market

Use charts, fundamental and technical analysis, and other ways to monitor the trade.

Step 6: Square-off from the Position

Close the position based on the trading strategy of your choice.

How to Choose an Ideal Broker for CFD?

As you can see, the first step in trading CFD is finding the right broker. The broker should be experienced, reputable, and reliable. There are thousands of brokers on the internet offering such services.

But, very few are legit and reliable. Assess your broker well and ensure they have all certifications. Check for insurance and experience.

You can sign-up with Mitrade and explore many benefits and trading opportunities.

FAQs:

There are so many questions about the topic of online gold trade India. Here are simple answers to some common questions:

1) Is It Still Profitable to Trade Gold?

Gold trading is still worth it like it has been in the past. The gold trading market offers investors massive opportunities. Even though prices can become volatile, the market remains rational.

2) Is Gold the Only Valuable Metal to Trade?

Silver is the most precious metal. But, gold is the most popular among traders and investors. Moreover, it is easy to forecast gold since it has a massive volume of buyers and sellers. Its market is accessible because of the enormous liquidity.

3) What Is the Best Time for Gold Trading?

Focusing on gold seasonality is one of the best ways of trading gold. Gold has the most substantial moves around September. The strength is also evident in January and February.

4) Is Online Gold Trading Easy?

Gold trading isn't difficult if you understand market dynamics. You may need to do technical and fundamental analysis. Check analyst commentary and the latest news.

You can use risk management tools to reduce losses.

Final Thoughts

Gold trading is volatile, and every new investor should know this. Prices are susceptible to a lot of external factors. Thus, you must know how polarities can change the gold market.

Analyze short and long-term trends well. While gold trading can give huge profits, it can also provide immense risks.

Be knowledgeable and get the right broker! Make sure you create a trading account at Mitrade

The content presented above, whether from a third party or not, is considered as general advice only. This article does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Mitrade does not represent that the information provided here is accurate, current or complete. For any information related to leverage or promotions, certain details may outdated so please refer to our trading platform for the latest details. *CFD trading carries a high level of risk and is not suitable for all investors. Please read the PDS before choosing to start trading.

- Original

- Trading Analysis

Risk Warning: Trading may result in the loss of your entire capital. Trading OTC derivatives may not be suitable for everyone. Please consider our legal disclosure documents before using our services and ensure that you understand the risks involved. You do not own or have any interest in the underlying assets.