Cryptocurrency vs Stocks: Which investment more suitable in India? What should you invest in?

In past few years, crypto has been trending on and off market. It has provided traders another option to upgrade their trading portfolio, but has it really brought change and shift the wave for traders? Is it really beneficial to invest your valued capital in crypto or rather stick to traditional methods like investment in stocks. Which option is really suitable for traders based in India? In this article, we will discuss some few points which will help you decide what kind of trading is actually good for you.

Situation of Crypto currency and Stocks in India

Crypto currency in India

The status for cypto has been very dicey for a long in India. Anything related to block-chain technology and cryto trading have been strictly regulated by the Indian government. Even the official bodies have trying hard to come up with cryptocurrency bill to handle the situation. The Indian government is currently formulating policy on Web 3.0. In order to be a significant player in the global Web 3 economy, it must participate in the global policy development and adapt its policies to this fast-moving world. Until then, Indian web3 startups will have to contend with a relatively conservative regulatory environment. According to a recent survey, India is the fastest growing cryptocurrency market in the world. It has grown at an exponential rate over the last five years, and its growth rate has been faster than that of any other country. Experts predict that India will continue to play a major role in the future of cryptocurrency if it continues on this trajectory.

Stocks In India

The Indian stock market has been in quite a good position for a long time. Indian stock market confronted a disaster in 2019 but we all are able to overcome that crisis. Now the Indian market is in a good position and India has become one of the world’s fastest growing economies. Indian market provides many options and various markets for investors to trade in. Stock market exchange like NSE and BSE has been for a very long time in the market and very reliable, moreover it has been regulated by official bodies like SEBI. As of now the Indian stock market is going strong and the future looks promising as well. The market was quite volatile after the International news events and inflation going on. But market experts are optimistic about the 2nd quarter of 2022. Also, According to Bombay Stock Exchange data the all India market capitalization has significantly increased adding up 9 trillion on last week. There was some pulling out of investments by FIIs in the last few months due to the Russia-Ukraine war situation. But nothing has changed fundamentally as the market looks full of opportunities for skilled traders and investors alike.

Why choose Crypto currency?

1) Timeline: Cryptos are mainly for short term investment and easy gains. Crypto’s price fluctuations might help you make money much more quickly than the stock market’s longer horizons, but can also lead to significant short-term losses but crypto can potentially offer higher gains. Which might raise some interest for short term traders even after all the risks involved.

2) New and Unstable: After coming out into the mainstream in 2017, crypto currency markets experienced an unprecedented boom, followed by a foreseeable nosedive that hit a lot of markets and companies hard. Lots of traders were under the impression that crypto currency was very unstable, but on the other hand stock market exchange were experiencing almost the similar turn down in various regions.

3) Volatility is key: For many new crypto users, the intense highs and lows is a big determiner. Crypto currencies are highly volatile and it can fluctuate many times in a day, which makes it perfect for day traders and other short term traders.

4) No-middle men: Cutting out middle-men is what crypto was initially all about. Decentralization lets trader have more control and there will be fewer intermediary fees and more power in the hands of the actual asset holders, addressing the monopoly of banks and their skewed power over people’s finances.

5) Dealing with consequence: Cryptocurrencies is not complicated, it don’t have such a burden, but this also means that they are difficult to integrate into the centralized system or highly regulated institution like stock exchange. Establishing laws for crypto, without authorizing an authority to execute the consequences, is complex. There have been many fake crypto currency cases in India which officials have sorted out properly.

6)Risk factor: As we all know, crypto currency works on block-chain, which is totally decentralized and not regulated by any fixed institution. The idea of block-chain itself contradicts the way the current financial system works, which relies on centralized institutions to determine how money is used. While financial laws help deter money laundering, fraud, and criminal activity, they also resulted in a bulky and bureaucratic system that benefits banks over the private consumer.

7) Hope for future traders: Despite the legal challenges crypto faces, there have some great strides. There is an increased demand for legitimized crypto services. Indian government is also working hard to integrate its system with block-chain to regulate and control crypto currency in a more efficient way. Being strict with compliance laws and KYC/AML procedures, for example, is how we strive to give crypto the credibility it deserves. Many crypto services still get away with being loosely regulated, but based on how huge corporations, the fate for crypto in India will soon change for the better.

Why Choose Stocks?

1)Stability: Stocks are very good option for both short term as well as long term investment. A well managed stock portfolio can sometimes offer a more stable home for your money than crypto investments.

2)Accessibility: Stocks are also more widely accessible than cryptocurrency. Many people have access to online trading platforms for stocks, while cryptocurrency requires specialized knowledge about block-chain technology and digital wallets. This makes it difficult for some people to invest in crypto currency without significant research and education.

3) Liquidity: Investing in stocks offers many benefits to investors, including greater liquidity. While crypto currency can also be a good investment option, it is not right for everyone. In order to determine which type of investment is best for you, consider your own preferences and risk tolerance when making your decision.

4) Wider range: Stocks tend to be more widely accepted and regulated, and they offer a wider range of investment options. Crypto currency is often seen as more volatile and risky, making it less attractive to some investors. Additionally, stocks are generally easier to buy and sell than crypto currency, making them more liquid.

5) Value for money: Stock value is derived by investor sentiment and actual revenue and assets backing it up. It derives its value from enough people saying it is worth something. Unlike stocks, it is backed up by nothing and can theoretically have negative value. A stock can’t be worth nothing because the company still presumably owns land, equipment, and other property that can be liquidated for cash.

6)Well regulated: Stocks have financial regulations that prevent insider trading, front-running, fraudulent financial reporting, skimming, and back-dated options. As of now, there are almost no financial regulations for a crypto broker, so they can charge anything, watch all the trades and make money by buying or selling, and has no audited financial statements.

7)More options and selection: There is a wide selection of stocks across different industries and sectors that are available to retail investors. Traders can choose equity based on a large number of criteria, from the company’s business model and location to whether or not they pay dividends.

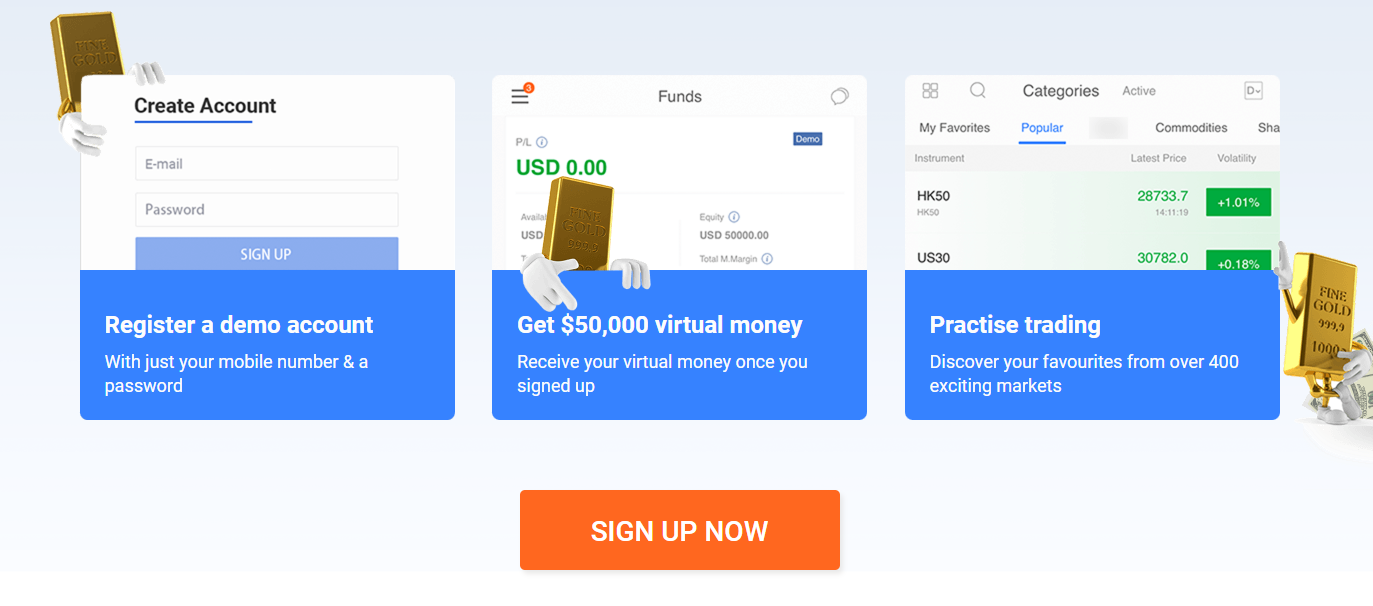

8)Easy and reliable: It is becoming easier to invest in stocks, with many online platforms and mobile apps emerging in the market. Many banks and brokers offers intuitive interfaces and are integrated with other financial services which is very user-friendly for both new and seasoned traders.

Conclusion:

From a trader’s perpective, considering From a trader’s perpective, considering your risk tolerance and past experience, you could consider investing in both. Adding crypto to your stock portfolio will not only add a great to add valued and diversification and at the same time will also open the door to potentially lucrative returns without leaving yourself fully vulnerable to the risks of either investment. Rational thought does not always govern our decision making. Most of the time in trading scenario, many traders stick to the things they know regardless of whether a less familiar option would be more beneficial. Crypto investment could be a great option for trading in Indian market. Meanwhile, stock exhange is and will always be a reliable option for traders.

The content presented above, whether from a third party or not, is considered as general advice only. This article does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Mitrade does not represent that the information provided here is accurate, current or complete. For any information related to leverage or promotions, certain details may outdated so please refer to our trading platform for the latest details. *CFD trading carries a high level of risk and is not suitable for all investors. Please read the PDS before choosing to start trading.

- Original

- Trading Analysis

Risk Warning: Trading may result in the loss of your entire capital. Trading OTC derivatives may not be suitable for everyone. Please consider our legal disclosure documents before using our services and ensure that you understand the risks involved. You do not own or have any interest in the underlying assets.