How To Invest In US Stocks From India For Beginners and US Market Opening Time In India?

The largest known economy in the globe is that of the United States. As a result of this increase, it houses the world's biggest stock exchange. Besides being the world's biggest stock market, it has one of the most outstanding track records.

Investors also can invest in firms that aren't readily accessible in their nations. Investors from India should take advantage of all these wonderful advantages by investing their money in the American stock market.

Every globally minded Indian investor has at least one burning question: How to invest in US stocks from India? This article will focus on addressing that burning issue. There are several factors to consider while investing in a foreign stock market, which is not as straightforward as investing domestically.

There is also a significant amount of interest among financiers in the possibility on how to buy US stocks from India. Before you begin, you need to be aware of a few things. You'll further learn all you need to know about the US stock market opening time in India as a beginner in this comprehensive guide.

Is It Permissible to Invest in US stocks From India?

Yes, it is legal to invest in US stocks from India.

The Reserve Bank of India (RBI) permits a citizen or permanent resident of India to invest up to US$250,000 per year in the stock markets of other countries as part of the Liberalized Remittance Scheme (LRS).

How to Invest In US Stocks From India?

Like Facebook, Apple(AAPL), and Google (GOOG), investors can find some of the top stocks in the world in the US stock market. As an investor, you can participate in the company's success narrative while diversifying your portfolio in the Indian stock market by purchasing these equities. Here are two ways to invest in the US stock market from India.

● Direct stock investments

● Indirect stock investment via mutual funds or exchange-traded funds

Before you can invest in US stocks from India, you will need to complete many vital procedures on a standard global investment platform. This kind of platform has the potential to be the most excellent brokerage account for international commerce.

Direct Stock Investment (step by step)

1. Opening A New Account

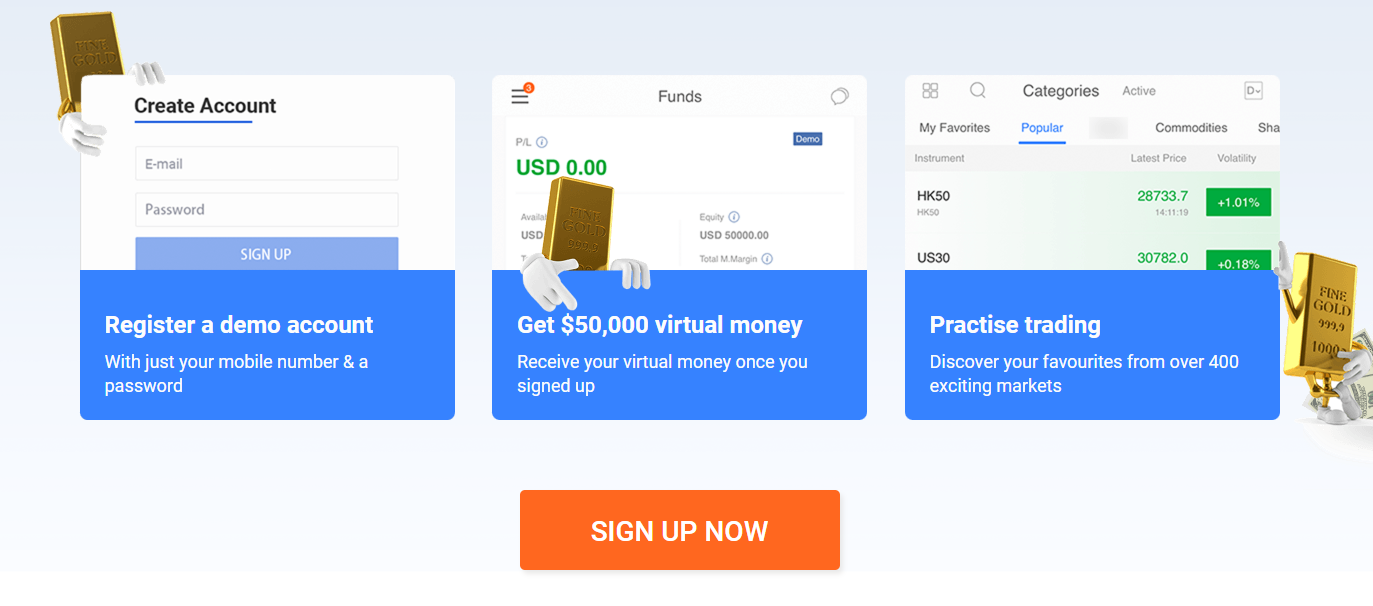

The first step is to register an account online after finding a reputable CFD Stock broker account like Mitrade in India to purchase US equities. It's a fast and straightforward procedure. Just enter your name, email address, and cell phone number to get started. A brokerage account is also opened for you when you open an account.

2. Verification

During the account opening procedure, you'll be prompted to show verification of your identity and address. The required paperwork is the bare minimum, which consists of a combination of address proof and identification proof (with a photo).

Voters' Registration cards, PAN cards, passports, or social security cards with pictures are acceptable forms of identification. It is possible to give evidence of residence through a utility or mobile phone bill or even a bank or credit card statement.

Alternatively, a valid driver's license that includes an address or another kind of government-issued photo identification that consists of an address, such as an Aadhaar card or a passport, would do.

3. Adding Funds

After your application has been reviewed and accepted, you will have access to your brokerage account's (Mitrade) money and will be able to make deposits.

4. The RBI rules

This is when things start to get extensive. Citizens who are keen on how to invest in the US stock market from India must utilize an authorized bank in the nation to acquire dollars (the currency of choice).

Once the funds have been exchanged for US dollars, investors can use them to invest in other countries. Following the regulations, a citizen of India can transfer a maximum of $2.5 lakh (about 1.82 crores) within any given fiscal year.

Before you begin trading, you must ensure that all of the necessary paperwork for the Liberalized Remittance Scheme (LRS) has been handled.

5. Currency Exchange Rates

The current exchange rate is of the utmost importance, particularly if you want to invest in US stocks from India. Check with your broker to see if they have a bank tie-up that might assist you in getting a lower rate. If not, you may request a wire transfer from your bank to your brokerage.

It's important to start small and develop your business after you've thoroughly understood the American market. Taking a big risk is not recommended by any financial professional, particularly for investors who are still new to how to buy US stocks from India and already face high exchange rates when changing rupees to dollars.

Finally, have a look at your risk-tolerance threshold. Investing in foreign equities is not without risks, and you risk suffering significant financial losses if you make even a single mistake. As a result, contemplate, evaluate, and then take your initial action.

International Mutual Funds

Additionally, there are American-based International Mutual Funds available in India that you can invest in. There is no cap on the amount of money that Indian nationals can invest here, in contrast to the strategy outlined above.

The main factor is that all investments are made in Indian Rupees rather than US Dollars. On the other hand, this tactic might end up costing more in the long run. It is simple to understand how this can occur, given that the overall cost ratio (fund management fees) is higher as a result of these investments in international schemes.

The Franklin Templeton feeder fund in India, which makes investments in the Franklin Templeton US fund, is a notable example. The Feeder fund will impose a further expense fee of 1.54 percent on top of the high cost of 1.82 percent imposed by the underlying US fund.

ETFs (Exchange-Traded Funds)

ETFs are another way to invest in US stock from India. A local or foreign broker may sell you US ETFs, or you can buy an Indian ETF that tracks an international index. ETFs may take either a straight or a more circuitous path.

Risks Of US Stocks

It is not without its dangers to invest in the US stock market from India. There is always the potential for the value of the currency to fluctuate. Your investment will be rendered useless if the worth of the Indian rupee declines compared to that of the US dollar.

There is also the possibility that the firm you invest in will not perform as well as anticipated, as well as the chance that the general stock market in the United States could fall. Nevertheless, there is also the possibility of gaining a lot of benefits.

Investing in US stocks, for instance, provides you with the option to diversify your portfolio and, perhaps, make more significant returns than you would if you invested in Indian stocks. This is because US markets are more volatile than Indian stocks.

If you are thinking about how to invest in US stocks from India, you must do your research and have a thorough understanding of the dangers that are involved.

Categories Of US Stocks For Indians

There are several categories of US stocks, and each one comes with its own unique set of advantages and disadvantages. The most typical kind of stock is common stock, which confers on shareholders the right to a claim on the assets and profits of the firm.

If a company is going through liquidation, preferred stockholders have precedence over ordinary stockholders, while debt securities effectively act as loans that must be reimbursed interest to the company.

When investing in US stocks from India, it is essential to research the many categories of stocks available to you. This will allow you to choose the stocks most aligned with your long-term financial objectives.

How To Invest In The Perfect US Stock?

When it comes to selecting the US stock that is most suitable for your needs, there are a few aspects that you should take into consideration.

● What are your objectives for investments? Do you want to build your investment portfolio over the long term, or do you want to see a return on your money right away?

● What is your risk tolerance? Are you prepared to take on greater risk for the possibility of more significant returns, or are you searching for a more stable investment? What are your thoughts on this?

● How much of your available capital are you prepared to put into American stock markets? What is your financial plan?

After you've given these considerations some thought, you can go on to navigate the various equities traded in the United States. A wide range of information at your disposal may assist you in making an educated choice.

You can locate the stock that is the greatest match for you by consulting with a financial counselor, reading reviews on the internet, and comparing several stocks.

US Market Opening Time In India

The anticipated US stock market opening time in India is an exciting event not only for participants in the market but also for the brokerage firms that trade stocks. Since everyone is aware that the time formats used across the globe are quite diverse from one another, the opening times of markets vary from nation to country.

The United States of America has two stock markets, which are very large and have a good reputation. These stock markets are the New York Stock Exchange and the NASDAQ. The time difference between the United States and India usually is 10 hours and 30 minutes, and in most cases, this variation in time affects every aspect of life in both nations.

Therefore, the opening time of the New York stock market is seven o'clock in the evening Indian standard time (IST), and the opening time of the NASDAQ is likewise seven o'clock Indian standard time.

The New York Stock Exchange, one of the major stock markets in the United States, is situated in the city of New York. Although NASDAQ is a second stock market, it is an electronic exchange used worldwide to trade securities.

Benefits of Investing In US Stock from India

1. Liquidity

The stock market in the United States presents Indian investors with the best potential to diversify their local portfolios by purchasing shares in some of the world's most successful technology, Internet, pharmaceutical, and manufacturing firms, amongst others.

Investing entirely in one economy (India) leaves you open to the threat of nation risk. There are a variety of micro and macroeconomic elements, as well as geopolitical events that may affect a country's economy.

Your portfolio will continue to be subject to consolidated risk even if the nation experiences internal economic or political strife. It would be best if you had a diversified investment portfolio to reduce the money you lose and increase the amount you can make.

You have the opportunity to diversify when you invest in US stocks from India; your portfolio will be well-rounded regarding asset classes, market capitalization, and other metrics.

2. Investing in Fractions

In the United States, as opposed to India, it is possible to own stocks in fractional amounts. After all, the cost of purchasing Amazon shares, which now trade for close to $3290, may be out of reach for certain people, given the need of approximately Rs 2.43 lakh to own a single share.

Nevertheless, even a little investment of Rs 5,000 or less would allow you to own a share in the company. You don't need much money to start collecting additional US stocks or building a portfolio, and you can do any of those things over time.

Knowing how to Invest in US stock market from India is a straightforward procedure that investors can complete in a short amount of time. The United States stock market is home to a diverse range of leading businesses from across the world, including those in the fields of technology and pharmaceuticals, as well as large-cap and small-cap stocks.

3. Rate Of Exchange for Rupees In Dollars

The Indian Rupee has been depreciating against the United States Dollar, as seen by historic statistics, and there is a chance that this trend may continue. The gains you get from investing in overseas equities are affected by the exchange rate of the rupee to the dollar.

Any drop in the value of the rupee relative to the dollar helps enhance profits on dollar-denominated investments, such as equities traded in the United States. If the rupee weakens compared to the dollar, you will make money even if overseas equities perform poorly or do not change.

Conclusion

Finally, this article has answered your questions about how to invest in the US stock market from India. Even though the market is highly profitable and the returns are generally high, always conduct your due diligence and comprehensive study, and seek current overseas investors for assistance in the sector before you invest in US stocks from India.

The content presented above, whether from a third party or not, is considered as general advice only. This article does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Mitrade does not represent that the information provided here is accurate, current or complete. For any information related to leverage or promotions, certain details may outdated so please refer to our trading platform for the latest details. *CFD trading carries a high level of risk and is not suitable for all investors. Please read the PDS before choosing to start trading.

- Original

- Trading Analysis

Risk Warning: Trading may result in the loss of your entire capital. Trading OTC derivatives may not be suitable for everyone. Please consider our legal disclosure documents before using our services and ensure that you understand the risks involved. You do not own or have any interest in the underlying assets.